For Rent!

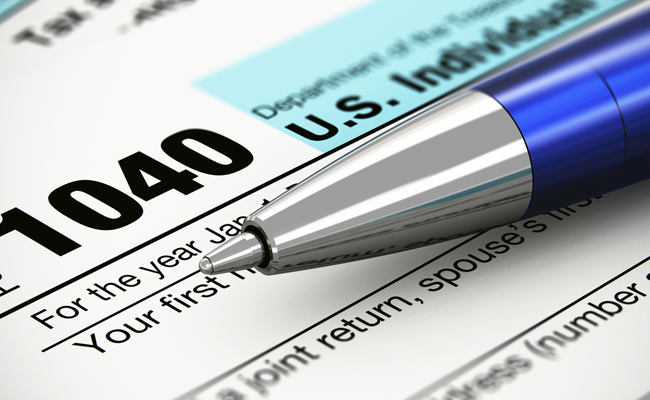

Say you are retired and decided to move in with your daughter and rent out your house, thereby, if you receive cash, property or services in return for the use of real estate or personal property, the value is taxable to you as rental income. Thus, that rental income form this property is reportable to you on a Schedule E, Supplemental Income and Loss

However, you can deduct the expenses associated with renting the property from your rental income which, depending on your circumstances, could lessen the tax bite considerably. Deductions might include repairs (but not additions or improvements) and operating expenses. You can also claim a depreciation expense for rental real estate.

Noteworthy: A US taxpayer can claim can also write off operating of foreign owned rental properties. Depreciation can be written off the building, but the gain on sale of property will be subjected to recapture.

Caveat Emptor: Many taxpayers rent out a room, the basement, a converted garage or an efficiency attached to the exterior of their home but do not report payments as income.

However, a very grey area that may void the homeowner’s insurance is utilizing the business model of the ‘sharing economy’ such as Airbnb to provide ‘guest services’ that may be deemed as providing commercial accommodations. As well as, working as an independent contractor for Uber to earn additional income could have some unintended consequences with respect to the taxpayer’s motor vehicle insurance policy.